In the popular Japanese drama "Hanzawa Naoki", the actor's own screw factory went bankrupt because the bank was unwilling to borrow money. Later, Hanzawa Naoki faced his own bank supervisor. The private granting and accepting of the borrowing company led to the problem of bad debts of 500 million yuan. After betting on his career, he finally recovered his assets, but was also exiled for offending his supervisor.

Banks have to lend money to earn interest, but how to find out the credibility of borrowers is the biggest problem. Among the various types of loans, the type like the screw factory owned by Hanzawa Naoki's father is actually the least risky, and it is also called "supply chain finance"

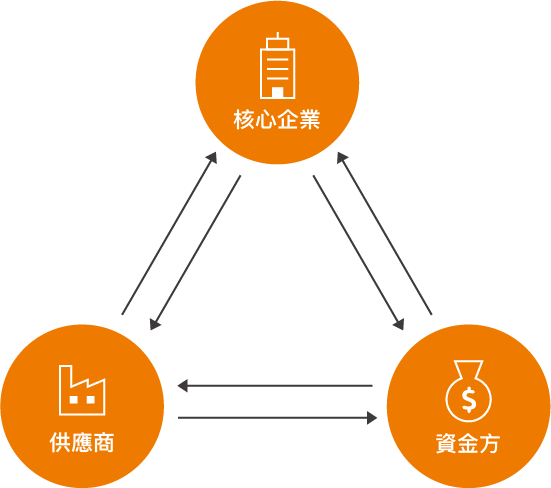

In the supply chain, the core enterprise is the main body. After they place an order and the OEM receives the order, they may need a sum of money to purchase raw materials, components or hire temporary manpower. After the order is delivered, they have to wait for the core enterprise(buyers) paying back. This period can be as short as 30 days and as long as half a year. If you want to continue to receive orders during this period, you may need another amount of funds for turnover. Hence, you need bank assistance.

Supply chain finance with the lowest risk has become a huge pit of fraud

This type of lending, known as "supply chain finance" or "accounts receivable financing", is a relatively low-risk lending business. The foundry has already handed over all the goods, but is just waiting for the core company's payment. Account entry is the safest short-term loan for banks. About 60 trillion NTD worldwide are accounts receivable.

However, in the manual review process, errors may still occur. The most famous recently is the Runyin fraud case. Runyin colluded with employees of upstream and downstream companies to forge contracts, invoices and purchase receipts in order to borrow 38.6 billion NTD from 9 financial institutions. One of the key breaches is the contact window for bank notes.

Since this transaction itself is relatively low-risk and the target is a large enterprise. In the process of the bank note, as long as a word from the contact window can almost be released, it becomes a vulnerable link. At this time, the blockchain technology with good confidentiality, fast information synchronization and tamper-proof has become a solution that many financial institutions pay attention to.

"There is a cost of trust while data exchange and blockchain can greatly reduce the risk here." said Daniel Huang, CEO of BSOS. In many international application cases, after the introduction of blockchain technology, companies initiated. It takes less than 48 hours to complete the loan until the time approved by the bank.

Taiwan's blockchain startup BSOS, in close cooperation with J.P. Morgan at the beginning of its establishment, is also the official technical ambassador of JP Morgan Quorum. And they are also the official partner of the R3 Corda. BSOS has stepped into two major consortium blockchain alliances. Got a good strategic position not only in Taiwan but worldwide.

However, in the bubble of the past year or two, blockchain innovation have almost changed from a popular star to a synonym for fraud. Many companies run away as soon as they hear blockchain innovation. However, BSOS has not only received 1 million USD investment from the National Development Fund,which is the highest amount invested by the National Development Fund’s angel round. Recently, they have also earned 3 large financial customers such as Taipei Fubon Commercial Bank and Cathay Financial Holding Company and Financial Information Service Company, becoming partners in the implementation of blockchain technology. Successfully put up a guarantee for their own sign.

Not to mention decentralization, have you ever heard ‘’tamper-proof’’?

The core technology of BSOS is called BridgeX, which is the total solution of enterprise blockchain. It can quickly build up a blockchain collaboration platform and connect with existing internal and external systems. It can provide protection for public and private account sharing. Point-to-point encrypted transmission to ensure safety.

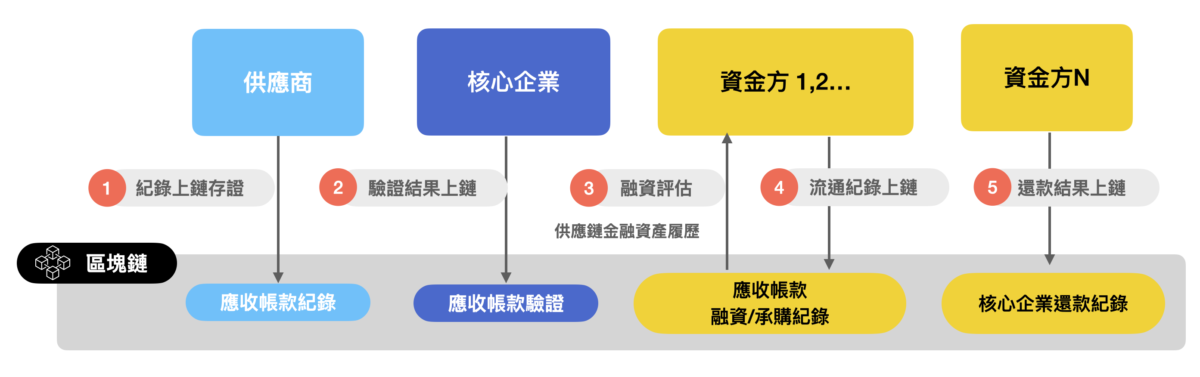

When this technology is applied to supply chain finance, it makes the originally cumbersome things unbelievable simple. For bank inspectors, after receiving the system notification that some companies have loan needs, they can see all the items that need to be inspected as long as they open the platform, including purchase orders, shipment orders, unified invoices, asset usage status, and third-party certification sign-off.

In this system, not only the documents are digitized, but each document is verified by the contract manufacturer and core enterprise. Most importantly, the system is synchronized with the enterprise ERP system(Enterprise Resource Planning system). How much goods are purchased and how much materials are used? They are all automatically connected, and all information on the platform is unique, and cannot be copied or tampered with. Every action is recorded.

"Enterprises and banks don't need to understand blockchain technology or research code. Through BridgeX, they can enjoy the benefits of blockchain. This is our main goal." Daniel Huang said that under blockchain management, they want to swindle loans. To pass the customs, there are a lot of people who need to be connected without a single window, and it is impossible to use the same documents to borrow repeatedly.

Blockchain has developed rapidly in the past three years. It is undeniable that it has taken a ride on cryptocurrency. However, the side effects are not small. Many people equate blockchain with money fraud and ignore the technical advantages. Although many companies gradually started to introduce blockchains last year, another problem is that companies are unwilling to share important information. When each is a "chain", it is equivalent to a broken chain.

However, in the financial field, the advantages of blockchain used to manage information and complex transactions are valued. Currently, it includes three aspects of inter-bank clearing, international trade finance, and supply chain finance. Within the scope, sharing some information with each other, as long as it can improve efficiency and create value, the enterprise can still accept it.

BSOS also sees this point clearly. Although it is good to talk about the ideals of decentralization, freedom and transparency, enterprise applications need "value". Focusing on this is the way to survive. In the future, with the cross-chain ecology, relevant regulations and the trust of enterprises is more mature, and Taiwanese startups also have the opportunity to enjoy a spotlight on this new stage.

Source: https://technews.tw/2020/05/04/interview-bsos-blockchain-in-supplychain/